The Silent Threat to Small Businesses – Operational Debt

“The future doesn’t arrive with a warning sign. It shows up quietly through small signals we choose to ignore.”

If you run a small business today, you’re probably feeling it already.

Work feels faster, expectations feel higher, and technology evolves quicker than most organisations have time to process. Every year brings new tools, platforms, and “must-have” systems promising efficiency, growth, and competitive advantage.

Yet many businesses don’t feel more efficient. They feel busier, noisier, and slightly overwhelmed.

In conversations with founders, directors, and operational leaders, one pattern keeps showing up:

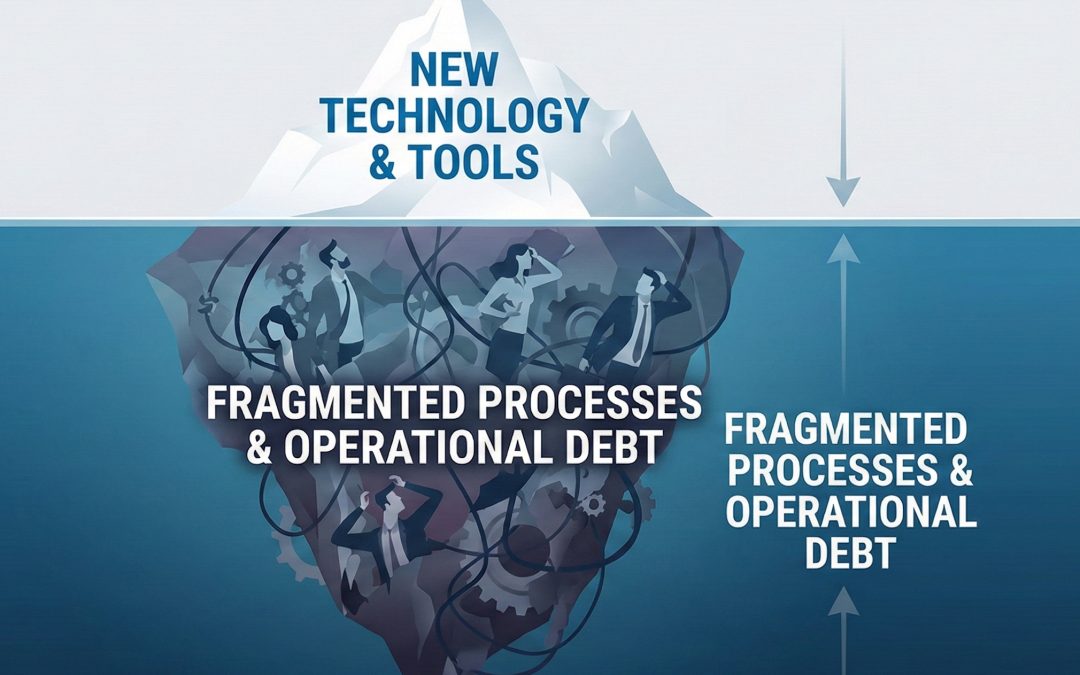

Organisations are adopting technology faster than they are improving the way they work.

This phenomenon creates what we call operational debt which simply means the accumulated cost of small workarounds, inconsistent tools, fragmented processes, and rushed decisions that never quite get fixed.

And while it doesn’t show up on a balance sheet, operational debt quietly influences performance, culture, and customer experience.

When Tools Multiply But Clarity Doesn’t

The modern business landscape is crowded with software – but being digital doesn’t automatically mean being efficient.

A recent analysis from Grant Thornton shows organisations often struggle to integrate technology effectively: one survey found that poor system integration remains the top obstacle to getting value from technology investments.

When systems don’t talk to each other, people end up doing the “integration work” manually which may include reconciling spreadsheets, copying data between platforms, and reconstructing truth from fragmented information.

This isn’t abstract, it’s real, measurable drag:

An IT Pro report suggests that software complexity is costing UK businesses up to £32 billion a year, partly because staff lose nearly seven hours every week dealing with convoluted tools and processes.

That’s almost a full working day wasted each week, not on customer work, not on strategy, but on managing the noise created by the tools themselves.

The Human Cost of Operational Debt

Technology isn’t the enemy. The real challenge is when processes and people don’t adapt alongside the tech.

For example, research at Gartner shows that more than half of customer service journeys now begin on third-party platforms like Google, YouTube and AI tools, compared to traditional first-party channels.

This signals a major shift in how customers expect businesses to operate, yet many organisations haven’t aligned their internal processes to meet those expectations.

Meanwhile, Gartner also reports that 60% of customer service agents fail to promote the very self-service options organisations pay for, simply because agents haven’t been empowered to do so.

This isn’t a tech problem. It’s a systems + behaviour + clarity problem.

People don’t burn out because they’re incapable. They burn out because work becomes unnecessarily difficult.

According to broader industry insights ( Market.us ), unclear processes, fragmented responsibilities, and technology overload are among the biggest inhibitors to productivity in digital transformation.

For small businesses with tighter teams, less redundancy, and limited buffer, this friction hits harder and faster.

Customers Feel Operational Problems Before Leaders Do

Customers don’t experience “systems” or “processes.” They experience repetition, delay, and inconsistency.

A PwC customer experience survey found that 52% of consumers stopped buying from a brand after just one bad experience.

That single moment of friction, be it a delayed response, an incorrect handoff or an inconsistent order, is where operational debt translates directly into lost revenue.

In a digital world where competitors are just a click away, heavy internal friction doesn’t just frustrate teams, it erodes loyalty and market share.

AI and Automation Won’t Fix Debt, They Will Expose It

There’s a belief that adopting AI and automation solves problems. But research indicates the reality is more nuanced.

Gartner has predicted that about 50% of organisations will abandon plans to significantly reduce customer service workforces using AI because human agents still play a critical role and AI adoption is more complex than expected.

In other words:

AI doesn’t replace the need for clarity but it certainly magnifies the consequences of not having it.

Automation only works well when the underlying processes are sound. If they aren’t, technology simply accelerates inefficiency.

This aligns with other industry reports ( LinkedIn ) showing that many digital “solutions” don’t deliver expected value because they were built on fragmented processes or unclear customer journeys.

The Competitive Advantage of Coherence

The future won’t reward the companies that adopt the most tools. It will rather reward the ones that align their tools with their organisation logic.

Clarity enables:

- faster and more confident decision-making

- unified customer experiences

- fewer repetitive errors

- more accurate data insights

- empowered teams who trust the systems they work in

As one strategy report from Grant Thornton highlights, organisations that can extract truly useful information from integrated data stand to make more proactive, company-wide decisions, rather than scrambling to find data.

This is what coherence looks like from the inside out.

Practical Signals Leaders Should Pay Attention To

Operational debt often reveals itself subtly, in daily frustrations and incremental losses of confidence.

Ask yourself:

- Do teams use the same tool differently?

- Do reports rarely match without manual cleanup?

- Are customers forced to repeat information across touchpoints?

- Does growth feel slower than ambition?

- Do decisions take longer because people don’t trust the data?

These symptoms might seem innocuous. Individually they feel manageable. Together they are the debt that burdens future success.

A Better Path Forward

Operational debt is not solved with louder ambition or bigger budgets.

It’s solved with disciplined simplicity:

- Observe before you automate. Clarify how work actually happens, not how you think it happens.

- Fix the process before adding new tools. Otherwise you’ve just made the chaos run faster.

- Map customer journeys truthfully. Look for friction points that cost confidence.

- Align teams on a single version of truth. Shared language, shared data, shared purpose.

- Build clarity as an organisational habit. Clarity is not a one-off project and its rather a leadership discipline.

Why This Matters for Small Business Now

Small businesses don’t fail loudly.

They fail quietly, in the spaces between tools, where processes are assumed rather than defined, and where experience becomes tacit rather than strategic.

The future will favour those who manage complexity with intention, not those who chase every new technology believing it will solve yesterday’s operational drag.

Operational debt shouldn’t feel like an indictment, it feels like an invitation to improve.

And the earlier you address it, the smoother your path forward will be.

Because success isn’t built on doing more. It’s built on doing the right things clearly and consistently.

How Vani Malik Consulting Helps Reduce Operational Debt

At Vani Malik Consulting, we work with organisations that are growing fast, but whose systems, processes, and customer journeys haven’t quite kept pace yet. Our approach isn’t about adding more tools or complexity. It’s about helping leaders see where clarity is missing, untangle operational friction, and redesign workflows so technology actually supports the way the business works.

From CRM optimisation and customer success frameworks to process mapping and operational alignment, we help teams move from firefighting to confidence, turning noise into structure and effort into impact.

Because the real competitive advantage isn’t having the most systems. It’s having a business that works in harmony.

If your organisation is beginning to feel the weight of operational debt, or you simply want a clearer, calmer way of operating as you scale, we’d be happy to talk.